Emails. Reports. Memos — you can write those all day long. But describing yourself on paper? That's a whole different story.

If that sounds familiar, then don't worry. Learning how to build a professional resume is a skill like any other — and like most other skills, it's one that can be taught.

That's why we put together this sample resume here. By following this tried-and-true professional resume outline, and breaking it down section by section, you'll learn exactly what to include as you get set writing your own. Even better, we'll walk you through every step of the way, and provide images of each resume principle in action.

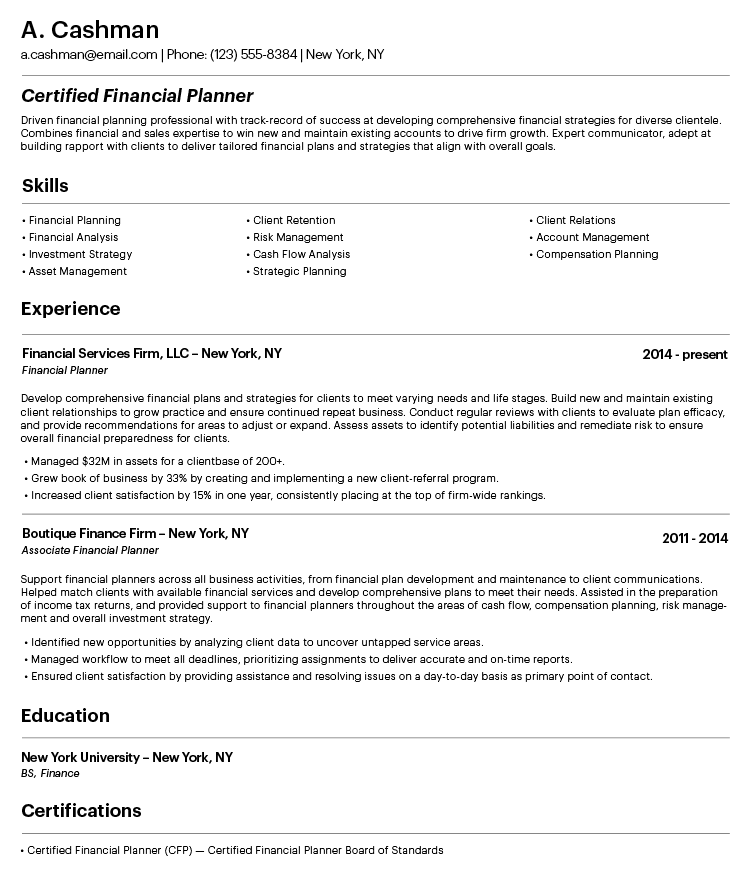

resume example

Ready to get writing and strengthen those resume skills? Let's get started.

components of a professional resume

1. contact information

If you're intimidated about writing your new professional resume, then starting with the straightforward “Contact Information” section can be a great way to build some momentum.

The rule of thumb is to display all necessary information clearly and in an easy-to-read format so hiring managers don't have to waste any extra time figuring out how to contact you once you've dazzled them with your career.

Get your name front and center and follow up on the next line with your personal email address and phone number. When writing your address it's up to you whether or not to include all the details. These days, nothing will likely be mailed to you during the hiring process, so just your city and state will do.

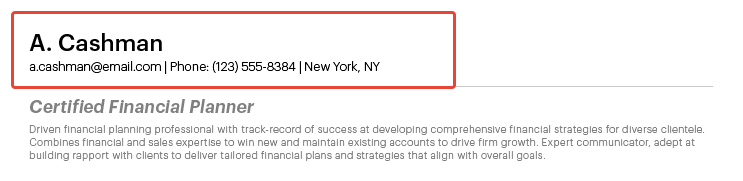

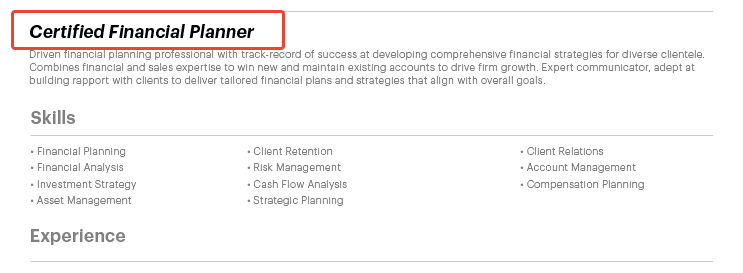

2. professional summary and skills

“Tell me about yourself.” There’s not a job seeker alive who doesn’t dread getting this common interview question. And when it comes to the professional summary section of your resume (sometimes also referred to as the resume “objective”), you’ll be creating the written version of that. The good news is that you’ll have as much time as you need to come up with a capable summation of your professional experience rather than having to do so while being on the spot. This section is composed of three parts: your resume headline, professional summary and skills. Let’s take a closer look at each one.

resume headline

Shoot for the stars here. If you’re applying to a position that will bear the same title as the one you currently hold, stick with that. But the beauty of this section is that it’s highly customizable. Meaning, it’s perfectly acceptable (and recommended) to title your professional resume after the position you’re applying for, rather than the one you currently hold.

To illustrate this point, let’s go back in time. Imagine it’s 2014 and our sample resume candidate, then an associate financial planner, is applying for their first financial planning position. In that case, they wouldn’t title their resume “Associate Financial Planner,” they’d go with “Financial Planner” instead.

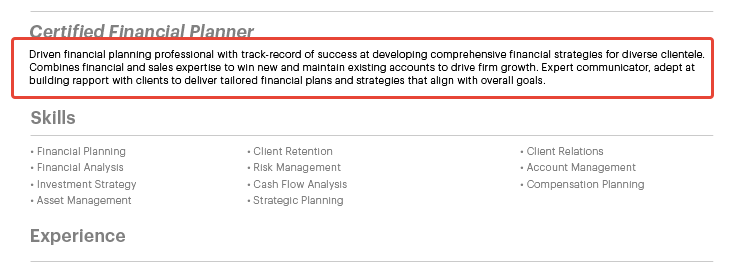

summary

You don’t need to go into too much detail here, but you do want to make sure you hit some of the major points of who you are as a professional to set the tone at the top, and give readers some context as to where you’re coming from.

Aim for three to five sentences, and refer back to the job description for clues as to what you should highlight about yourself upfront. Try to capture the broad strokes of what the position will entail, rather than speaking to the nitty gritty of every desired qualification or listed responsibility. For our financial planning example, financial acumen, client relations and sales-like account management skills are the pillars of success for the profession, so we spoke to them there.

As you write your resume, you’ll want to use the implied first person perspective, but your professional summary is the one exception. Take a look at the second sentence in the resume summary sample we provided above. You’re not saying “I combine,” but you’re not saying “He/She combines,” either. To cut down on unnecessary words and improve readability, eliminate pronouns and proceed with an implied, third-person perspective.

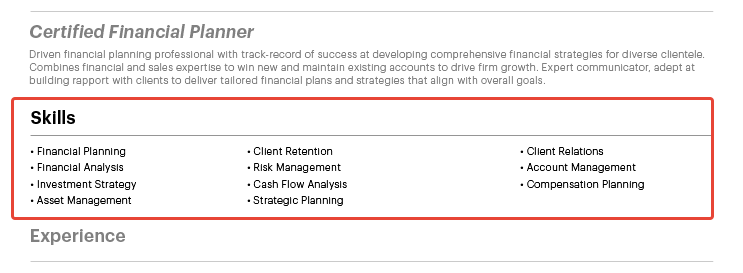

skills

You’ve got too many to name, so stick with the skills that are most applicable to the position you’re applying for. Refer back to the job description to find keywords that appear often or are listed as qualifications or requirements, and add them to this section on your resume.

Many HR teams will be using an automated applicant tracking system (ATS) to filter resumes before they review them, so this section doubles as a useful tool for getting your resume through the early rounds of automated screening and into the hands of a decision-maker.

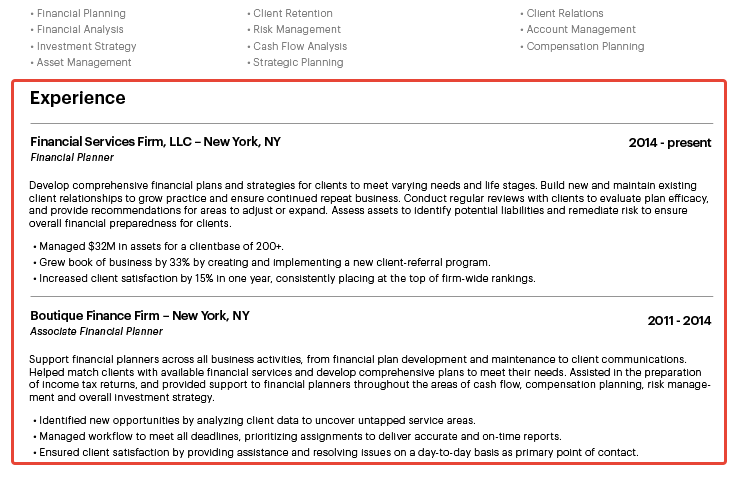

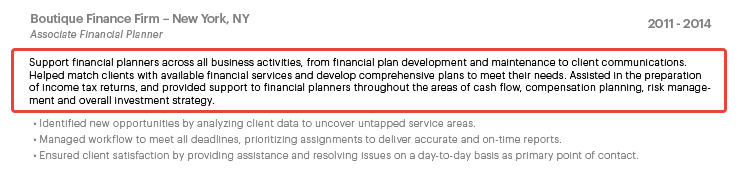

3. professional experience

Order this section in reverse chronological order, with your most recent position at the top going back about 15 years. Employers are most interested in your recent work experience, so going too far beyond that will create a longer and more-daunting-to-read resume.

Now comes the fun part: describing what you did and accomplished in each role. The good news is that once you know the basic formula for constructing this section, it practically writes itself.

The secret is to break down each role into a short paragraph of your responsibilities, followed by a few bullet points highlighting your major accomplishments. That’s it! Here’s a closer look at how to put it all together:

paragraph of responsibilities

Begin each job section with a short paragraph outlining your major responsibilities in each role. Think in general terms about what you did most often and on a day-to-day basis. Any special projects or one-off assignments you can cover in the bullet points that follow.

bulleted list of accomplishments

Follow up your paragraph with three to five specific accomplishments, ideally ones that can be measured. Numbers jump off the page, so think in terms of revenue generated, percent increases and dollars saved.

4. aand certifications

You’re almost there. The heavy lifting has been done, and now all that’s left is to wrap up your new professional resume with a quick section about your education and certifications. If you’re a recent grad, it’s perfectly acceptable to list your graduation date, but in all other cases, feel free to leave it out.

Afterward, create a new section for certifications, listing only those that are applicable to your field or position along with the institution that bestowed them. If you have any additional training certifications or awards, you can list them out too in the same format under additional “Training and Certifications” or “Awards and Recognition” sections.

ready, set — write

Following these steps won’t let you down, and if you take it section by section, you’ll have a polished, professional resume in no time.

If you’d still like more help writing your resume, or need help throughout the other stages of the hiring process, visit our Career Resources page. It’s got all you need to know about resumes, cover letters, interviewing and more.

download resume sample

download resume sample